Zoftify

Work

Work

Our travel and hospitality industry expertise enables us to consistently deliver successful solutions that help businesses grow

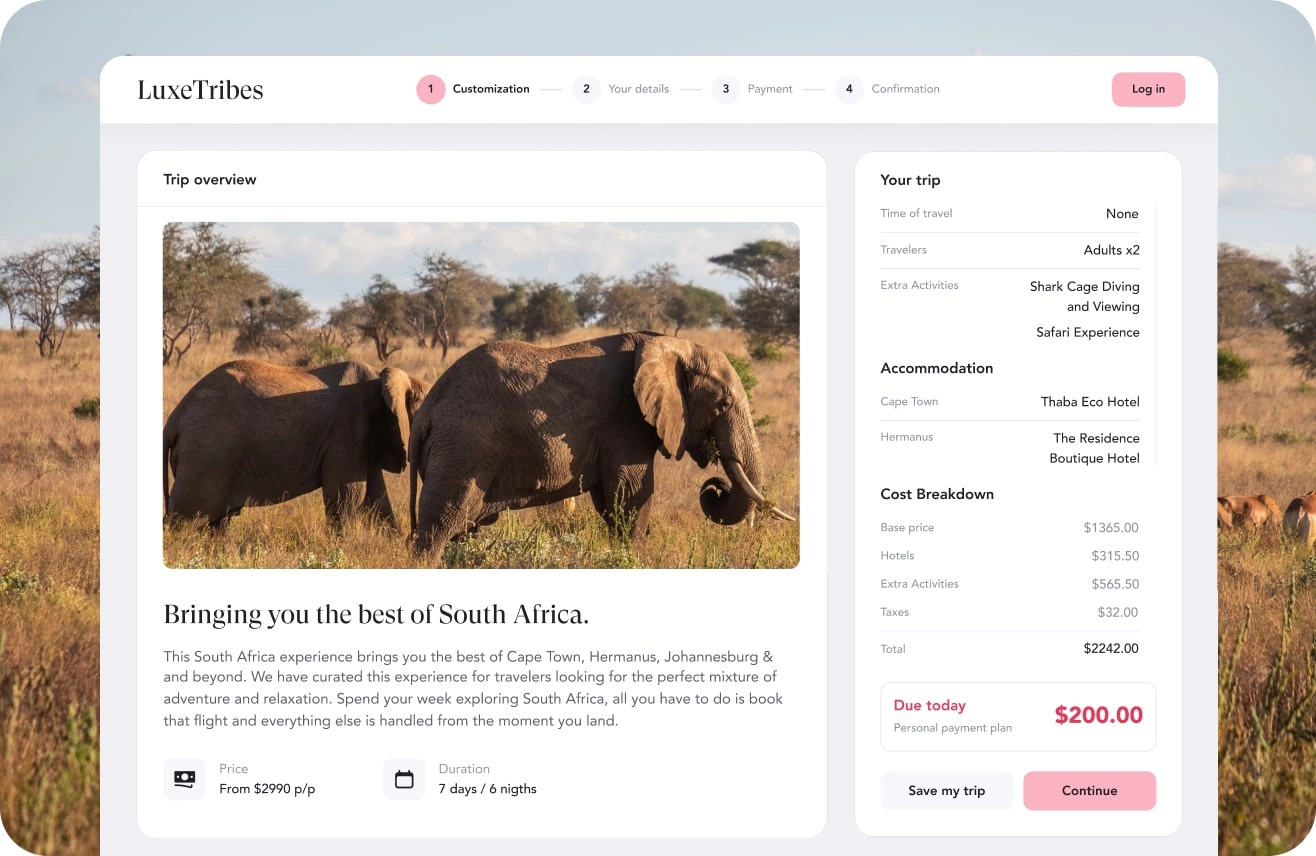

Reimagining the booking process for a luxury travel company

We designed and built an innovative booking system that simplifies the booking process and automates operational tasks.

500 hours

of development saved with our pre-built codebase

4x

reduction in time spent processing bookings

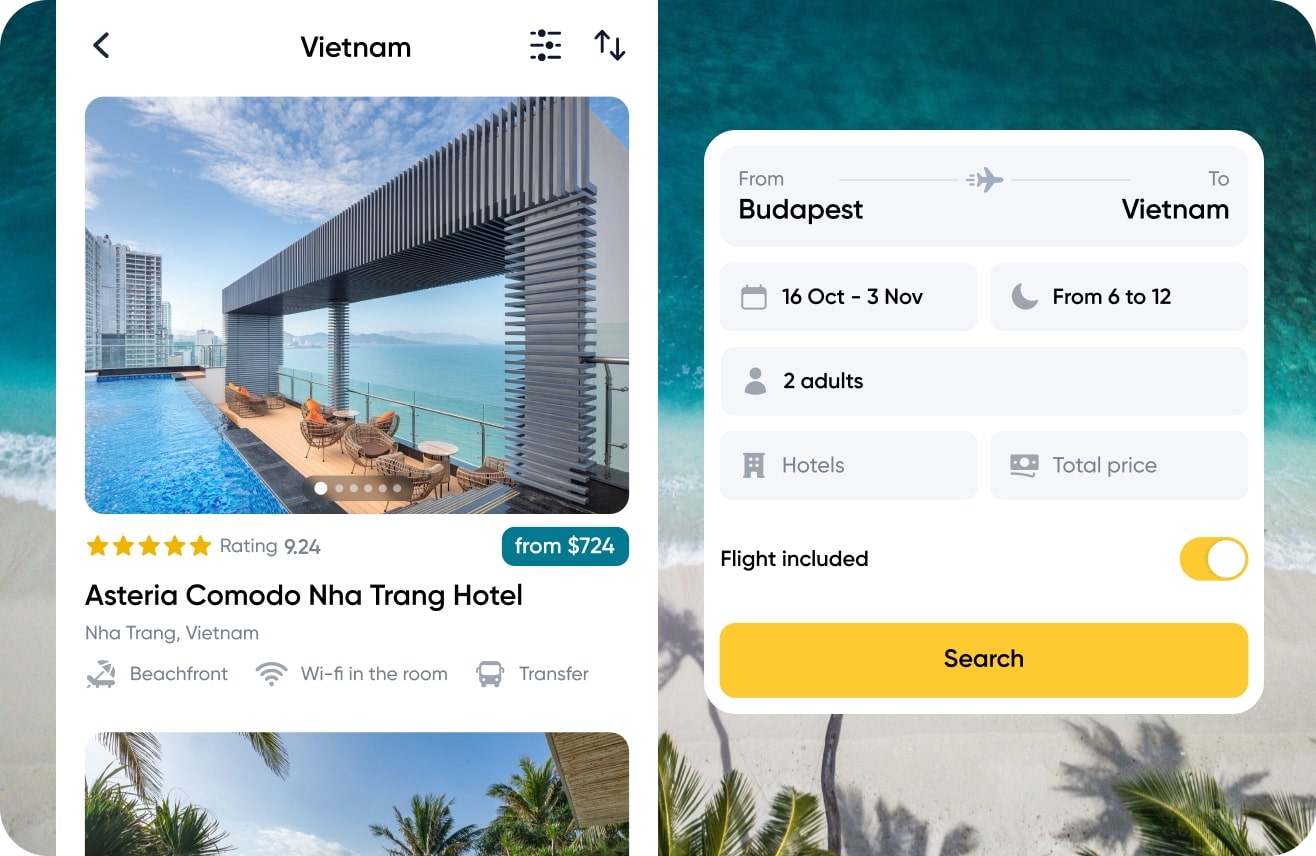

Hyper-niche accommodation booking platform

Conversion-optimized white-label booking platform with various travel API integrations.

640 hours

development hours saved with our pre-built solution

8

travel portals from a single codebase

From spreadsheets to success with a custom PMS

We created a custom PMS for property managers overseeing 150+ properties.

98%

reduction in availability tracking issues

150+

properties managed with the PMS

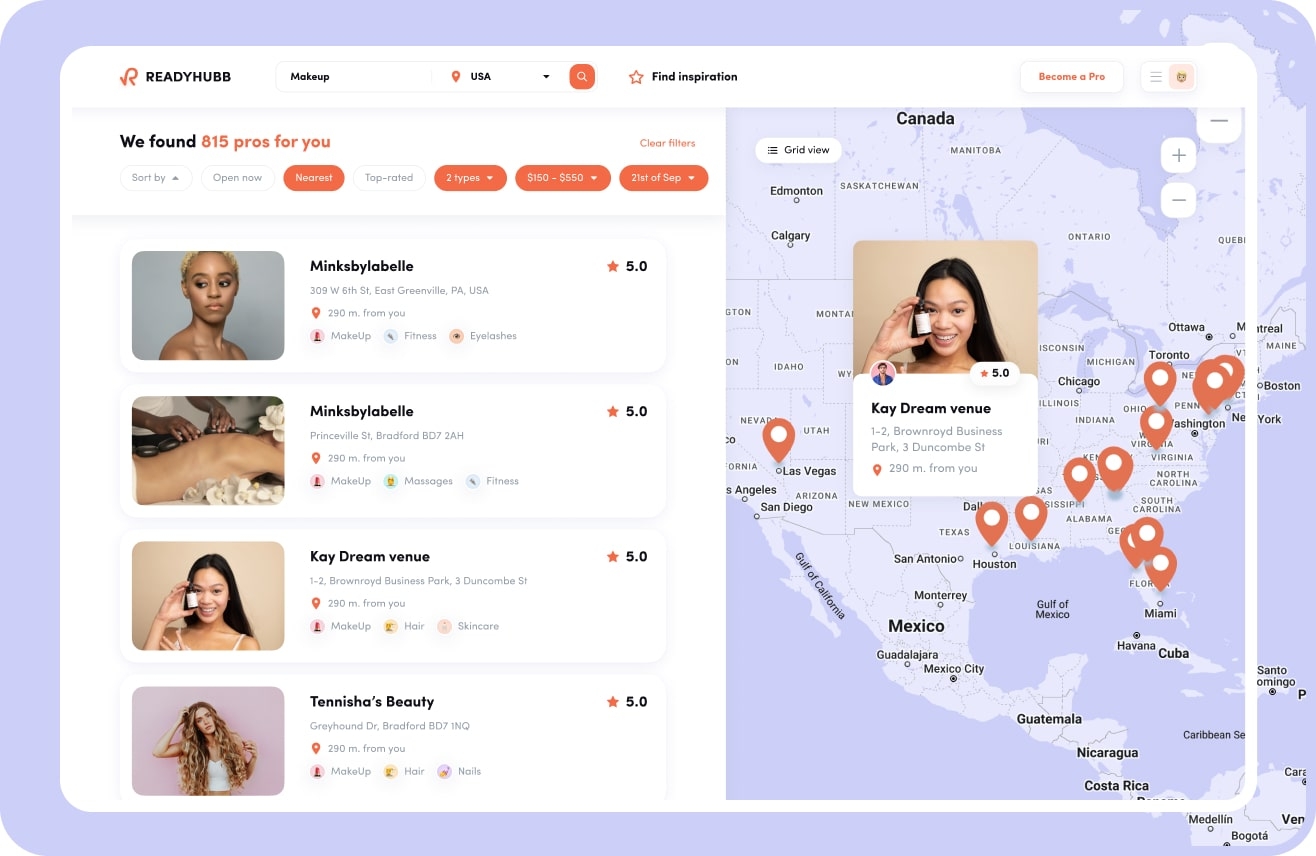

Custom booking software for independent professionals

We built a cross-platform marketplace app with booking functionality and a custom-modified map.

Forbes

featured

2000+

businesses now listed on the platform

How we built and maintained 16 apps for a travel agency

We developed a distributed system of mobile apps co-branded with the names of renowned tour operators in Europe.

73%

bookings made via mobile apps

+55%

increase in repeat bookings

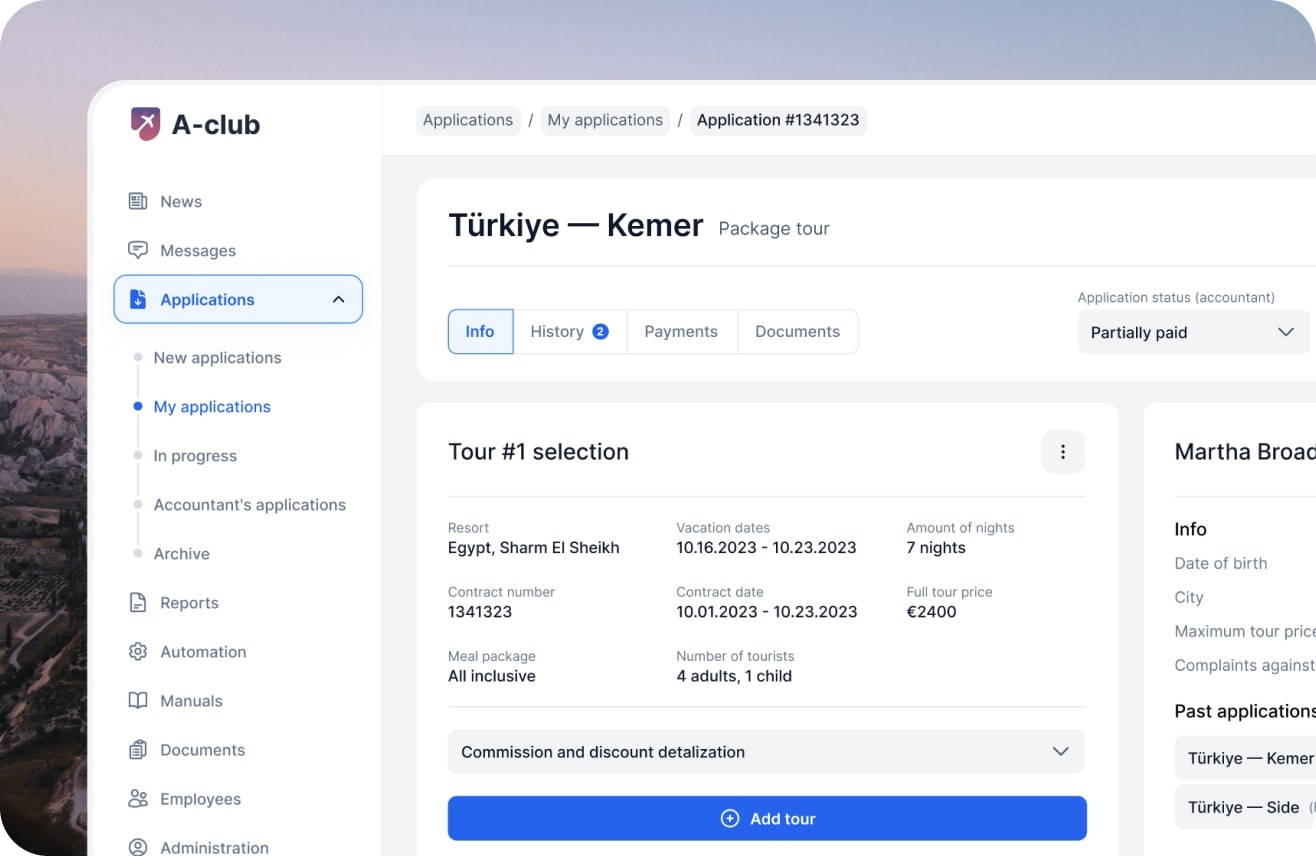

Driving productivity with a custom travel agency CRM

We developed a custom CRM for the travel agency, significantly boosting its operations

30%

more deals processed with no need for extra staff

95%

fewer missing payments to tour operators

What our clients say

Chidi A.

Founder, CEO at Luxe Tribes

I have to commend Zoftify team for their excellent work on our recent project. The team were instrumental in delivering our project on time and with the utmost professionalism. Their attention to detail was particularly impressive, and their communication throughout the project was excellent.

Denis B.

CoralTravel, LLC A-CLUB

They are experts in development, backend, and integrations. Our apps have more features, less bugs and significantly improved performance.

Streamlining the Dutch rental market with a mobile app

Zoftify designed a user-friendly app that simplifies long-term rentals in the Netherlands